Since the beginning of 2021 in SIGEA by Gisma we decreed that this would be the year of Corporate Sustainability, so we are optimistic about the incentive provided by the “S&P IPSA ESG Tilte”.

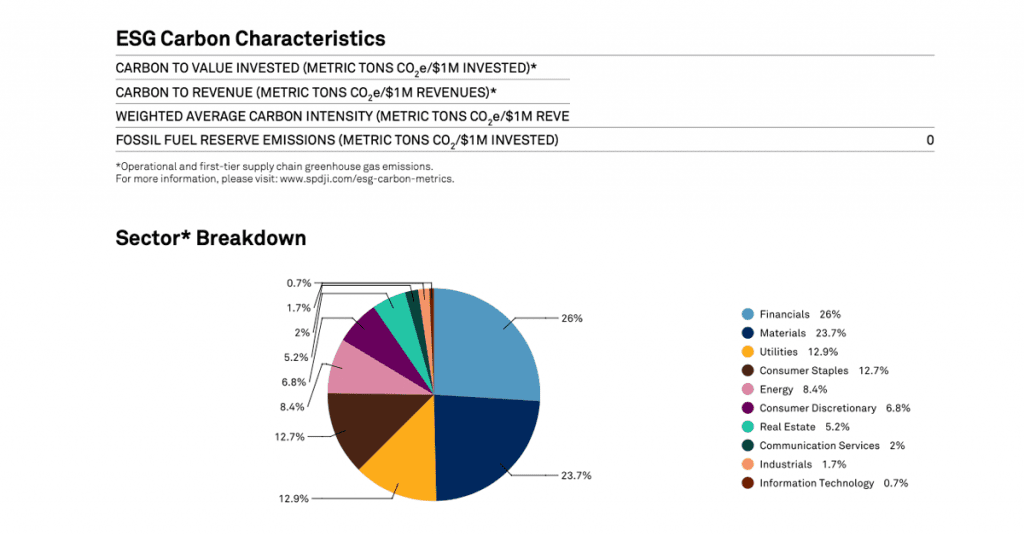

What is it about? As the official website of the S&P Dow Jones Indicators giant explains, the S&P IPSA ESG Tilted Index was designed to measure the performance of eligible stocks in the S&P IPSA that meet sustainability criteria .

Thus, this derivative of the Dow Jones Sustainability Index (DJSI) seeks to highlight the companies that have the best management of the principles of sustainability. ESGThis will contribute to raising standards at the local level, since in its alliance with the Santiago Stock Exchange, it considered 26 companies in our country, including Copec, Falabella, Cencosud and SQM.

This news has an impact on the entire equity market, as it is already more than a trend for investors to prefer socially responsible instruments, as the challenging 2020 showed us.

As Diario Financiero reported in January: “some investors now see ESG assets as a ‘safe haven’ in times of crisis” and thus the universe of total ESG asset funds increased from US$ 3 trillion in 2019 to approximately US$ 7.2 trillion (million million million) in 2020. Similarly, sustainable investments in the US increased to US$ 17.1 billion at the beginning of 2020, up 42% from US$ 12 billion two years ago according to data from the US SIF: The Forum for Sustainable and Responsible Investment survey.

With this openness and awareness of investors, the good management of ESG principles and the organizational capacity of each company will make the difference with respect to its valuation in the stock market.

As mentioned in the article “How to ensure our investment is sustainable and avoid the confusion of greenwashing.”In addition, efforts today should be aimed at “strengthening the capacity to effectively measure, monitor and manage ESG factors of companies and projects, to separate the wheat from the chaff and put investment where there is a measurable positive environmental impact”.

In fact, the responsibility that each company assumes by being within this indicator is not minor, because once there, the path is to continue improving standards and not in reverse. Our clients listed in the S&P IPSA ESG Tilted Index know the importance of having products such as the SIGEA® Corporate Compliance module, which is built to facilitate the management of information on environmental indicators within large corporations, systematizing the assignment of reporting responsibilities, automating and facilitating the entry and processing of data for the subsequent preparation of reports that account for compliance with ESG criteria, crucial to ensure more investment to corporations.

“In the past year, ESG issues have undeniably taken hold as an essential strategy for the traditional investor, as the COVID-19 pandemic and social justice issues put a strong focus on the importance and relevance of sustainability data and principles.”said Reid Steadman, global director of ESG indexes at S&P Dow Jones, to Emol.com.

In the same media, José Antonio Martínez, general manager of the Santiago Stock Exchange, stated: “Sustainability is a strategic pillar for the Santiago Stock Exchange, on which our purpose of publicizing, disseminating and promoting best practices in ESG terms is based” adding that: “As articulators of the capital market, with the incorporation of this new indicator we seek to encourage companies to manage ESG factors with the highest standards, as well as to provide tools for better investment decision-making, with the aim of promoting the sustainable development of the market and enabling Chilean issuers to position themselves globally.”

Companies traded on the Santiago Stock Exchange considered in the S&P IPSA ESG Tilte:

- Enel Americas

- CMCP S.A. Companies

- Banco Santander de Chile

- SQM

- Banco de Chile

- Empresas Copec S.A.

- Falabella S.A.

- Cencosud S.A.

- BCI

- Parque Arauco S.A.

- CAP S.A.

- Viña Concha y Toro S.A.

- Embotelladora Andina S.A. (Series B)

- Entel

- Aguas Andinas S.A.

- CCU S.A.

- Compañia Sud Americana de Vapores S.A.

- Itaú Corpbanca S.A.

- Plaza S.A.

- Probe S.A.

- Inversiones Aguas Metropolitanas S.A.

- ILC S.A.

- Cencosud Shopping S.A.

- Security Group S.A.

- SMU S.A.

- Ripley Corp S.A.

Sources

Emol.com: https://www.emol.com/noticias/Economia/2021/01/20/1009942/Bolsa-de-Santiago-indice-sustentable.html

Diario Financiero: https://www.df.cl/noticias/mercados/bolsa-monedas/wall-street-se-vuelca-por-las-inversiones-en-esg-jp-morgan-estima-que/2021-01-25/192949.html

S&P Dow Jones: https://www.spglobal.com/spdji/en/indices/equity/sp-ipsa-esg-tilted-index